Edwin Way Teale said this, and it’s a nice reminder, especially about coming out of a long winter. They say we have to earn our summers in Maine, and after the early April snowstorm, that seems very true this year. The start of “spring” this year feels a bit heavier than others. I’m not sure if it’s the current state of the world, the endless seasonal colds, an election year, tax season, or the common conversations of the push and pull of trying to “do it all and be it all” amongst several women in these held circles, but leaning into the smell of blooming flowers, longer days full of sunshine and sandy toes makes us feel like anything is possible.

When life feels heavy, the community often helps. Leaning into a good friend, a new activity, a good hug, or a walk with a bud—together taking deep breaths of fresh air—community gives us a sense of belonging and the assurance that we are not alone in some of these feelings. As life can sometimes spiral in unexpected directions, community helps remind us of our sense of purpose and our intentions.

Perhaps even being more intentional with our finances! We have to start somewhere, right? Due to the early April snowstorm, we postponed our financial literacy event to May 30th. Tickets are still available, and we wanted to provide a sneak peek of the conversation planned for that evening! We chatted with Molly C. Reinfried and Michelle R. Santiago of HM Payson below on a few of the topics they plan to discuss more in-depth on the 30th.

Can you provide three key ways to be more financially savvy?

Pay yourself first by setting up automatic transfers to your investment account so you can save at regular intervals automatically without additional steps. Also, make sure to prioritize where you are saving so you can first allocate your savings to take advantage of any contribution matches provided by any employer-sponsored retirement plans.

Take inventory of your personal balance sheet and cash flow, so you can better monitor them over time. A balance sheet identifies your assets (what you own) and your liabilities (what you owe). Building a balance sheet will help you determine the strengths and weaknesses of your financial position as it helps identify things such as how many months of expenses you have in cash; how many of your assets are cash-producing (savings, investments), and how many are cash-consuming (personal real estate); and how much total debt you have. Your balance sheet will help determine your net worth, which is simply your assets minus your liabilities. A cash flow statement will allow you to understand better the sources of your cash (income) and the uses of your cash (expenses). This is critical to saving more effectively, managing debt obligations, and ultimately increasing your net worth.

For long-term goals, focus on growth. How you invest your money (stocks vs bonds) will depend on your investment objective, which, in turn, depends on your time horizon. If your time horizon is long (5+ years), as it typically is with retirement, then the investment objective should be growth, which means you’ll invest funds in stocks.

As an entrepreneur, do you recommend a budget management tool?

Budgeting is a means to develop strong savings and spending habits. Begin by dividing your cash flow into three categories: essentials (aim for 50% or less), financial priorities (20%), and lifestyle (30%). Essentials include your basic needs like food and housing. Financial priorities include additional payments towards debt or saving for college and retirement, while lifestyle includes all your discretionary spending, like entertainment and travel. Using this simple 50 / 20 /30 approach will keep your spending on track.

Once you’ve established this budgeting framework, you can use budget management tools such as Quicken to help you manage your personal finances, or even Quickbooks if you’re looking for more tools to help manage the financial aspect of your small business.

As tax day has just passed, what is the best way to set yourself up for success to ensure taxes aren't stressful for you next year?

Start by reviewing your personal balance sheet and cash flow. From there, it’s important to set up your automatic and proactive savings plan to ensure you’re getting the most out of potential tax deductions, such as saving to your retirement plan or Health Savings Account.

It’s also helpful to have quarterly check-ins on your taxable items to ensure you are withholding sufficiently throughout the year to prevent large amounts from being due when you file and potentially avoid underpayment penalties.

Quarterly check-ins can also be helpful to keep you organized and ensure you’re gathering and keeping track of tax information throughout the year rather than waiting until the end to do so. This can be particularly helpful for those who are self-employed, have rental income and expenses, or make charitable contributions at various times throughout the year, as it will ensure you’re keeping track along the way.

If you could go back in time and provide your younger self with financial advice, what would you tell her?

It’s important to remember that you are in control, so you should stay focused on what’s most important to YOU. You can do this by setting goals and prioritizing those goals. It is also important to understand the economic choices you make so your decisions are then consistent with your rank order of priorities. But remember to also be flexible on the small stuff.

I would also remind my younger self that it’s okay to start small, especially when time is on your side. Starting out with your first job, it may seem daunting to be able to save to meet your financial goals, but that’s where the power of compound interest comes in. Compounding refers to the ability of an asset to generate earnings on previous earnings. Saving small amounts can have a profound effect on wealth. But when an individual starts to save has an equal, if not greater, impact on how much wealth is accumulated. The sooner you start to save, the more time there is for the interest earned on your savings to compound.

What’s making you feel like anything is possible? Let us know - we love to hear from held subscribers. Tenaya and I share a few things that are sparking joy lately, when life feels more complicated than usual - it’s the little, simple things! (PS: “It’s the little things.” It might also be a held Substack section if it sticks! I'm winging it as we go, folks!)

Tenaya

Discussing the “play” event on May 16th with Jess Barzell and hearing her hysterical ideas and activities for getting us all to be more playful and vulnerable.

Watching Jenny Slate’s latest comedy special, ‘Seasoned Professional,’ which is streaming on Prime Video.

Celebrating seder with friends on Monday, April 22nd, and feeling grateful for my family and friends’ safety, health, and well-being.

Listening to Dax Shepard and Monica Padman’s Armchair Expert podcast while driving around town.

Jamming out to “The Tower” by Future Islands while my daughter yells, “Change the song!”

Feeling the moments of warmer weather and sunshine and thinking about friends and family who will be visiting us this summer.

Mare

Looking at dinner china to plan an upcoming dinner party—I can’t get hot dogs on china out of my head since our first gathering! Thank you to Eva of The Spoondrift Kitchen for that!

The children’s book Be Kind - the end always sticks with me - Maybe I can only do small things. But my small things might join small things other people do. And together, they can grow into something big.

Making this salad to have all week long - easy peasy lunch!

Bopping to this beat!

This podcast shared by future held event host Jennifer Wiessner - health is wealth, and Dr. Mary Claire Haver breaks down perimenopause and menopause terms and helpful tips perfectly

These happy pants

The Spice Girls - that line - “Hey you, always on the run, gotta slow it down baby, gotta have some fun.” - they were onto something.

And now for more held happenings…

Convos & Candy - Let’s Play! - THURSDAY, MAY 16 · 6-8 PM @ Belleflower Brewing Company

Research shows that play has many benefits, including sparking creativity, relaxation, and mental acuity. Join Jess Barzell, Pilates instructor, dancer, artist, and play guru, for an incredibly fun evening that will inspire us all to be more playful.

Join financial advisors Michelle Santiago Esq., CFP®, and Molly Reinfried, CFP®, for an evening discussion and tutorial on the financial mistakes we’ve all made and steps to gain control of personal finances and well-being. No financial knowledge is required! Before we delve in, we’ll loosen up, dance, and have some fun with instructor Maggy Bassingthwaite.

Communication and Sexual Empowerment - THURSDAY, JULY 25 · 7-9 PM @ O’MAINE STUDIOS

Join Jennifer Wiessner, a Social Worker and Sex Therapist, for an educational tutorial on why we might struggle to talk about sex and how to change that. This thought-provoking tutorial will help attendees feel less burdened, acquire knowledge on how to improve connection and leave with additional resources to help support them on their journey.

SHOUT OUTS

This section is a quick shout-out to women who inspire held.

Shift with Shannon - Shannon works with people who are navigating life’s inevitable shifts. From the mountainous to the mundane, our daily lives are forever shifting. Whether you’re experiencing a career change, processing a difficult diagnosis, settling into parenthood, moving to a new home, or simply dealing with daily stressors, Shannon can help you find a way forward. She collaborates with people who want to get their shift together by reflecting on their behaviors and examining the stories they tell themselves.

CLASSIFIEDS

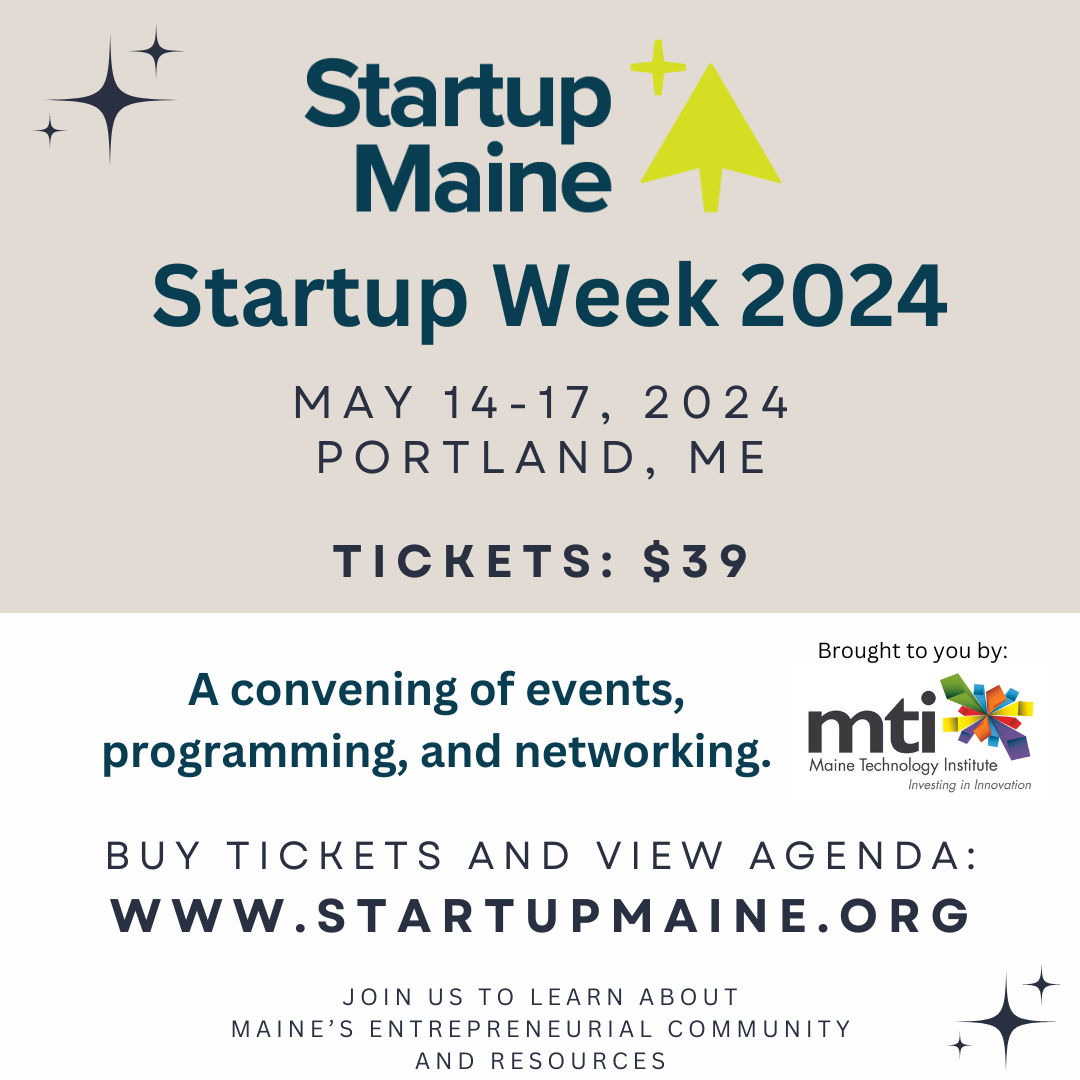

StartUp Maine is bringing back the StartUp Maine Conference from May 14th to 17th. Startup Maine is a resource hub within the entrepreneurial ecosystem. It serves as a convener for founders, tech workers, entrepreneurial support organizations, funders, and those who are startup-curious. This will be their first conference since 2019! For more information on the programming and tickets, check out https://www.startupmaine.org

About Classifieds: Need to promote your upcoming event, a new business venture, looking to be connected to other community members for job possibilities, an exercise bud, volunteering, a babysitter etc. Reach out to us, and we will be happy to include your information here!